Companies (Accounting) Act 2017 Quick Guide

The Companies (Accounting) Act 2017 was finally commenced on 9 June 2017. This Act transposes the EU Accounting directive 2013/34 into Irish Law which was expected to be enacted in mid July 2015.

This Act allows accountants and companies to finally utilise Section 1A of FRS 102 and FRS 105 assuming certain requirements are met.

When is the commencement date?

The mandatory commencement date is for periods beginning on or after 1 January 2017. Section 14 of the Act permits the Act to be early adopted for all periods commencing on or after 1 January 2015.

There is no requirement for the Act to be cited as the Companies (Accounting) Act 2017, instead it can be referred to as the Companies Act 2014.

Can the Companies (Accounting) Act 2017 be early adopted, if so from when and do all sections have to be early adopted?

The Act can be early adopted for all periods commencing on or after 1 January 2015. Where the option to early adopt has been chosen all sections other than those stated in Section 14 of the Act must be applied. It is an all or nothing approach.

Where early adoption is availed of by companies, recognise that the following Sections in the Companies (Accounting) Act 2017 cannot be early adopted (everything else can be and must be if the adoption option is chosen):

– Section 27 & 28 inserting new Section 305A relating to requirements to disclose payments to directors who are third parties;

– Section 58 – amending the wording in Section 360 dealing with audit exemption – changing wording from ‘group’ to words ‘group company’

– Section 60 – amending the wording in Section 363 which deals with audit exemption in a nongroup situation – change in wording has no significant relevance.

– Section 61 – amending the wording in Section 364 which deals with audit exemption in a group situation – change in wording has no significant relevance. In addition, a change clarifying where first annual return is late then this does not bring a company into audit.

– Sections 65 – change in wording to Section 393 which has no significant impact

– Section 66-73 – minor changes/insertions to S.412, S.634, S.865, S.914, S.916, S.919, S.934 & S.943 which will have no impact on the financial statements or audit exemption.

– Sections 74 – Changes to Section 1002 dealing with the disapplication of provisions of Part 1 to 14 of Companies Act 2014 for PLC’s to include the use of Small & Micro companies regime.

– Sections 75 & 77 – Changes in wording to definition of ineligible entities in the case of PLC’s; PUC’s & PULC’s.

– Sections 76 – insertion into Section 1230 not to permit PUC’s to apply and qualify for the small & micro entities regime.

– Section 78 – Replacement of existing Section 1274 with a new Section 1274 where the definition of a designated ULC is changed.

– Section 79 – Insertion of new Section 1274A which dis-applies Part 26 (concerns payments to governments) for ULC’s (other than designated ULC’s);

– Section 80 –Section 80 – Change to definition of EEA & Non-EEA company in Section 1300 with regard to external companies; Replacement of existing S.1274 with a new S.1274 where the definition of a designated ULC is changed & disapplication of Part 26 (concerns payments to governments) is included. This applies to branches in the state where it is owned by an unlimited company outside the state which in turn is owned by a limited company outside the state. It effectively states that where such a structure exists, then the branch must file financial statements and register as a branch in Ireland (as is currently the case for a company incorporated outside the state which is a limited company). Note there is no set date for this change to be implemented/commenced. A separate commencement order will issue to commence this section.

– Replacement of existing S.1274 with a new S.1274 where the definition of a designated ULC is changed & disapplication of Part 26 (concerns payments to governments) is included.

– Section 83 – insertion of Section 1384A dealing with Section 393 (reporting of category 1 & 2 offences) and its applicability to public offers of security – Replacement of existing Section 1274 with a new S.1274 where the definition of a designated ULC is changed & disapplication of Part 26 (concerns payments to governments) is included

– Sections 85-86 – insertion of S.1400A dealing with definition of ineligible entities for the purposes of Section 275 and financial statements with respect to its applicability to investment companies

– Section 87 – insertion of new Part 26 dealing with payment to governments;

– Sections 90-101 – Numerous inconsequential changes from a financial statement, audit exemption or consolidation perspective.

What companies would early adoption suit?

Companies that meet the qualifying conditions and wish to apply the Small Companies Regime/Section 1A of FRS 102 or the Micro Companies Regime/FRS 105. Other benefits of early adoption for certain companies as applicable include:

– the ability to claim audit exemption due to the increase in thresholds as discussed further in this paper.

– the fact that a late first annual return does not exclude a company/group from claiming audit exemption.

Note Private Unlimited Liability Companies can also early adopt so as to take advantage of these benefits. The fact that the ULC early adopts does not mean the new definition of a ‘designated ULC’ comes into effect early. Section 14 of the Act specifically allows an entity to early adopt but confirms that the Section dealing with the definition of a designated ULC does not apply where early adoption arises.

Opportunity for certain companies as a result of early adopting

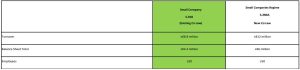

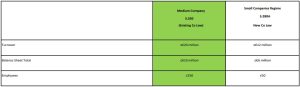

A Company/Group that meets all other requirements for the small companies regime and its results are within the thresholds in the table below, can now under this Act, claim audit exemption (assuming they meet two of the three requirements) and can also file small company abridged financial statements. Currently such a company is classified as a medium company and therefore cannot claim audit exemption, must file significantly more detail in financial statements filed with the CRO and must prepare financial statements under full FRS 102.

Would some companies be better off not early adopting; if so why and how can the negative impact be delayed?

Yes; the following entities should consider whether it is in their best interest to early adopt:

– A group which is currently below the current consolidation thresholds on the basis of size under Section 297 of Companies Act 2014 (i.e. T/O≤€20m; Total Assets ≤€10m; Employees ≤250) and the group does not qualify as a small group (due to the thresholds being exceeded or an excluded company being included within the group) in new Section 280A-280C as inserted by Companies (Accounting) Act 2017 and defined in the table below.

- If early adopted such a group cannot claim exemption from consolidation as Section 297 has been repealed under Companies (Accounting) Act 2017.

A company currently classified as a medium company under the existing Section 350 of Companies Act 2014 with results in between the thresholds detailed in the table below and who will be unable to apply the small companies regime as inserted by Companies (Accounting) Act 2017.

- If adopted early, then such a company cannot avail of the medium company abridged financial statement option, as abridgement for medium companies does not exist under Companies (Accounting) Act 2017 as this section is repealed.

– A holding company of a group which meets the conditions for small company abridged financial statements under current company law (but the group overall does not meet the definition of a small group and consolidation size threshold is not exceeded).

- If adopted early, then such a company cannot avail of the small company abridgement option as Section 280B only permits abridgement for a holding company where the group as a whole is considered a small group.

A company currently classified as a medium company under the existing Section 350 of Companies Act 2014 with results in between the thresholds detailed in the table below and who will be unable to apply the small companies regime as inserted by Companies (Accounting) Act 2017.

– A Small company as defined under Section 350 of CA 2014 (As Section 350 is repealed under CAA 2017) who do not wish to file the new type of small abridged financial statements as these new type of abridged financial statements will provide additional information which the companies do not want in the public domain. The abridged financial statements under small companies regime include additional disclosures as the abridgement option only permits the directors report and profit and loss account to be omitted; all other notes in the full FRS 102 S1A financial statements must be included (e.g. fixed assets notes, debtors/creditors notes, contingencies, subsequent events, exceptional item notes etc. etc. need to be included).

- If adopted early additional items would need to be disclosed in the small company abridged financial statements

How can the negative impact be delayed?

– The company/group change its year end date to a date just prior to 31 December 2016 (e.g. 30 December) as the new Act is only mandatorily applicable for all periods commencing on or after 1 January 2017. This gives the company another year before it will need to apply the new rules (e.g. instead of applying the New Act for year ended 31 December 2017 assuming a 31 December year end, it would mean that it would only apply for the year ended 30 December 2018 – another 12 months deferral).

Bear in mind a company can change its year end within 7 days either side of its existing year end every year. However, where the change is done outside this range, then under Section 288 of CA 2014, it can only change its year end date once every five years and it cannot be for a period of greater than 18 months. Note if a change in year end is made, the company needs to ensure that the company’s annual return date is adjusted (can only be adjusted once every 5 years).

Is there any incentive for large companies to early adopt?

No. The Act introduces administrative changes to the financial statements. Where consolidated financial statements are prepared and the parent company provides a Section 357 guarantee (guarantee to cover the liabilities of the subsidiaries) and therefore only files the consolidated financial statements with the CRO, the new Act requires that the guarantee not only cover the liabilities of the subsidiaries shown on the balance sheets as is currently required but in addition to this; off balance sheet liabilities. This therefore increases the extent of the liability to be guaranteed.

What are the key points?

The principle differences from the existing legislation are:

– An increase in the current size thresholds for small and medium companies together with the introduction of thresholds for a medium group and micro company thresholds. See existing and new thresholds below:

– A reduction in size criteria for holding companies exempt from preparing consolidated financial statements. Under the Act 2017 all companies other than small or micro group’s (that can avail of the small or micro companies regime) must prepare consolidated financial statements. Currently all medium sized groups avail of this exemption which is not permitted under the Act 2017.

– Expanded definition of whether a lower company is a subsidiary company of a superior company to include persons acting in their own name or on behalf of the superior company

– An increase in the number of groups and small companies that can avail of the audit exemption and/or file small company abridged financial statements if applicable as a result of the increased thresholds.

– Once the small company definition is met then that company can qualify for the small companies regime. This will allow companies to adopt Section 1A of FRS 102. Section 1A of FRS 102 requires the financial statements to be prepared using the recognition and measurement requirements of FRS 102 but to use the disclosure requirements of the Companies Act small companies regime as opposed to the more detailed disclosure requirements of each of the Sections within FRS 102.

However as the financial statements are still required to show a true and fair view, directors of companies will still have to consider whether additional disclosures on top of the Companies Act disclosures are required to show the true and fair view. Once Section 1A of FRS 102 can be claimed it will allow entities to claim exemption from the requirement to prepare a cash flow statement.

Although not required by company law Section 1A encourages entities to include the below in order to ensure the financial statements show a true and fair view:

a) include a statement of compliance with FRS 102;

b) a statement that it is a public benefit entity if applicable;

c) the disclosures relating to going concern;

d) a transition note where it is the entities first time adopting FRS 102;

e) present a statement of comprehensive income (i.e. an OCI) – there is a legal requirement to detail movement on any revaluation reserve.

– Once the micro company definition has been met then that company qualifies for the micro companies regime. Once the company applies the micro companies regime it may then apply the financial reporting standard ‘FRS 105’. FRS 105 does not require any further disclosures in addition to those required by Company Law. Under FRS 105:

- assets are not permitted to be carried at fair value or revalued amounts;

- all amounts on the balance sheet must be recognised at historic cost;

- development expenditure must be expensed;

- investment property must be depreciated;

- no deferred tax is required to be recognised.

This is a very simple standard and the financial statements will just include:

- a profit and loss account (format to be in accordance with Schedule 3B of the Act 2017),

- a balance sheet (format to be in accordance with Schedule 3B of the Act 2017); and

- limited notes to comply with the micro companies regime, the main ones being the disclosure of:

- the accounting policies note;

- movement and details of loans given to the directors and guarantees or credit transactions entered into for the benefit of directors;

- details of contingencies, guarantees and commitments;

- pension scheme accruals;

- the write off period for goodwill and the reasons for choosing it;

- dividend declared, not paid but accrued;

- a note detailing any departure from company law in order to show a true and fair view;

- a change in classification in the profit and loss or balance sheet from the prior year;

- a change of accounting estimate; and

- movement on the profit and loss reserve in the current and prior period.

– No business review required to be included in the directors report for small companies applying the small companies regime.

– A holding company of a group must meet the medium/small group requirements/thresholds in order for a small/medium holding company to be able to be classified as a small/medium company for company law purposes. This differs from existing legislation as even where a small company does not meet the definition of a small group and consolidated financial statement are not prepared it can apply some of the exemptions available to small companies in its own right if the company itself meets the definition of a small company (e.g. the ability to file small company abridged financial statements).

– The ability for medium companies (as defined in new Section 280G) to file abridged financial statements will no longer be available.

– Companies that apply the micro companies regime in the preparation of financial statements are deemed to show a true and fair view. No further disclosures are required.

– Additional disclosures required to be included by directors in the small company abridged financial statements given the fact that the new Act 2017 requires the balance sheet and all notes included in the full S.1A FRS 102 financial statements to be included in the abridged financial statements (i.e. it is only the directors report and profit and loss account that is excluded in the abridged financial statements). Current legislation provides very specific guidance on what notes to include. That said there is no requirement to disclose wages & salaries of employees or details of name, class of share, net assets & profit for investments where >20% interest in a class of share is held.

– Introduction of three new schedules dealing with the format requirements for companies applying the small and mirco entities regime; Schedule 3A for small companies regime, Schedule 3B for the micro companies regime and Schedule 4A for small group companies applying the small companies regime.

– Small changes to the existing Schedule 3 of Companies Act 2014 which deals with the accounting principles, format and content of financial statements. Examples of changes include: no need for a comparative fixed asset note, accrued income to be disclosed separately in the notes, wording in the profit and loss account is to exclude the words ‘on ordinary activities’.

– Ability to apply the IFRS formats to the profit and loss and balance sheet

– Ability for the profit and loss account to be referred to as an ‘income and expenditure account’ if applicable.

– In the consolidated financial statements where exemption is claimed not to disclose the parent entity profit and loss account, the profit/loss must be disclosed in the face of the entity balance sheet (currently disclosed in the notes).

– Where first annual return is late the company is not excluded from claiming audit exemption (currently only permitted by concession by the CRO).

– The Act 2017 requires that the Irish Auditing and Accounting Supervisory Authority (IAASA) shall be allowed to attach terms and conditions to an authorisation of certain categories of liquidator.

– The Act 2017 abolishes “non-filing structures” in their current form for Irish unlimited companies by expanding the definition of designated ULCs to include additional corporate structures.

– The Act 2017 requires entities where a limited liability company is included above an unlimited company (i.e. a limited parent company with a ULC subsidiary/subsidiaries) to file financial statements for the ULC with the CRO by expanding the definition of designated ULCs to include additional corporate structures such as these. This would mean entities that have structures whereby at least 51% of a ULC is held by a limited company or the Limited company holds a golden share (i.e. it is a subsidiary of a parent) with the remainder (or even 1 share) owned by an individual, then these ULC’s will require accounts to be filed.

– The Act 2017 requires entities where a limited liability company is included above an unlimited company (i.e. an ULC parent company with subsidiaries) to file the unlimited Company financial statements with the CRO by expanding the definition of designated ULCs to include additional corporate structures such as these. This section does not commence until 1 January 2022.

– The Act 2017 inserts a new Part 26 ‘Payments to Governments’, containing the Directive’s requirements with regard to preparing and filing with the CRO, by large companies, large groups and public interest entities active in the mining, logging and extractive industries, annual reports on payments made to governments.

– The Act 2017 obligates auditors to report on the corporate governance statement to ensure information is consistent, whether material misstatements have been noted and that the report complies with the requirements of the Act

What do accountants need to know/do?

Review their client listing to assess which companies can apply Section 1A of FRS 102 and which can apply FRS 105 and plan the practice schedule accordingly.

Advise clients of the additional choices available with regard to accounting standards (FRS 105/Section 1A FRS 102) on commencement of this Act 2017 and the benefits this will provide with regard to the reduced disclosure requirements.

Assess whether it is beneficial to early adopt Companies (Accounting) Act 2017 for periods beginning on or after 1 January 2015 for their clients. Circumstances which would indicate it may not be beneficial are:

•A group which is currently below the current consolidation thresholds on the basis of size under Section 297 of Companies Act 2014 and the group does not qualify as a small group in new Section 280A-280C of Companies (Accounting) Act 2017.

•If early adopt cannot claim exemption from consolidation

•A medium company under the existing Section 350 that cannot apply the small companies regime.

•If apply early, then cannot avail of medium company abridged financial statements option as it does not exist under Companies (Accounting) Act 2017. Might make sense to change year end date to a period ending prior to 1 January 2017 so as to get another year filing abridged financial statements.

Recognise that the mandatory commencement date is 1 January 2017 with early adoption permitted for much of the Sections in the Companies (Accounting) Act 2017 for periods beginning on or after 1 January 2015 (sections which cannot be early adopted have been detailed above). Where the option is taken to early adopt, then ensure that all relevant sections of the 2017 Act that must be applied have been complied with, companies cannot pick and choose which sections to early adopt.

Recognise the fact that FRS 102 S.1A and FRS 105 can be applied for periods beginning on or after 1 January 2015. Where early adoption is availed of by accountants, understand that not all the Sections in the Companies (Accounting) Act 2017 can be early adopted (however if you do early adopt you must adopt all of the Sections stated in Section 14 of the Act – companies cannot pick and choose the sections to adopt):

For Section 1A of FRS 102 advise the directors of the decisions that will be required to be made by them in assessing whether additional disclosures are required on top of the Company law requirements in order to show a true and fair view.

Advise holding companies of medium group’s that currently claim exemption from preparing consolidated financial statements on the basis of size, of the reduced size thresholds with regard to this exemption. The thresholds will now be reduced to the new small group thresholds as detailed above. For entities where this applies, it may be more beneficial not to adopt Companies (Accounting) Act 2017 early as they can continue to use the old thresholds for periods beginning before 1 January 2017.

Accountants that have prepared financial statements in accordance with the FRSSE ‘effective 1 January 2015’, FRS 102 or old GAAP if still applicable for the previous period end will need to assess the transition adjustments required on transition to FRS 105 to derecognise certain assets and liabilities due to the simplistic nature of this standard.

Advise clients of the benefits and drawbacks of adopting the micro companies regime so that directors of companies really appreciate the implications of choosing FRS 105 and the micro companies regime.

Some of the implications are:

– If the company increases in size the company will then no longer meet the requirements of the micro companies regime and as a result will have to go through the pain of transitioning to a new accounting standard all over again;

– Given the simplicity of the financial statements, for an external party reviewing these financial statements, they may not provide enough detail e.g. banks, potential customers.

– The company’s balance sheet only shows cost and does not allow entities to show fair values.

Advise clients who are currently classified as a medium company on the basis that they do not meet the current small company thresholds/requirements in Section 350 of the fact that the thresholds will be increased which will therefore provide those entities with the ability to claim audit exemption and file small company abridged financial statements (therefore resulting in less information being available to the public in the CRO) on the adoption of the new act assuming the company meets the increased threshold requirements and the requirements in S.280A-280B. For such entities, it would be beneficial to adopt FRS 102 early (i.e. prior to the commencement date).

Advise clients of the impact S.280B may have on holding companies that when taken together do not meet the requirements of a small group. If the small group exemption is not met then the holding company cannot be considered a small company for the purposes of filing abridged financial statements. As a result full financial statements must be filed with the CRO. Under company law which existed before Companies (Accounting) Act 2017 such a holding company can/could apply the exemptions for abridged financial statements. For such entities, it will be more beneficial not to adopt Companies (Accounting) Act 2017 early.

As a result of the increased exemptions for a small company and the possibility of claiming audit exemption, review the client listing to assess which companies can claim audit exemption on adoption of the Act 2017. Where it results in an entity being able to claim audit exemption, it would make sense for these entities to early adopt Companies (Accounting) Act 2017.

Advise clients who prepare consolidated financial statements of the new requirement to disclose the profit/loss of the parent entity on the entity balance sheet.

Be aware of the new exemptions from the disclosure of directors remuneration under S.305, 305A, 306 and transactions and arrangements with directors under S.309 (other than amounts owed by directors to the company as this will still require disclosure under S.307 & S.308) for companies that qualify for the micro companies regime therefore reducing the amount of information visible to the public.

Advise clients who are likely to fall within the new medium company thresholds that the abridgement option to only disclose results from the gross profit line in the profit and loss account will no longer be available and therefore the turnover and cost of sales figures will now need to be disclosed on adoption of the Act 2017. For such entities, it will be more beneficial not to adopt Companies (Accounting) Act 2017 early.

Advise clients (that have companies that apply the small companies regime) of the additional disclosures that will need to be included by directors in the small company abridged financial statements given the fact that the new Act 2017 requires the balance sheet and all notes included in the full S.1A FRS 102 financial statements to be included in the abridged financial statements (i.e. it is only the directors report and profit and loss account that is excluded in the abridged financial statements). That said there is no requirement to disclose wages & salaries of employees or details of name, class of share, net assets & profit for investments where >20% interest in a class of share is held. In addition S1A has less disclosures in the full financial statements.

Advise group’s that currently provide a Section 357 guarantee (to allow the subsidiary to file the company’s consolidated financial statements instead of its own) of the fact that the parent will now have to guarantee not only the liabilities recognised in the balance sheet of the subsidiary at the balance sheet date as is currently required but also commitments of the subsidiary at that date that were not required to be recognised.

Be aware of the change in some formats to the profit and loss account and balance sheet as included in the revised Schedule 3 (applicable to all companies other than those companies that apply the small or micro companies regime), the new Schedule 3A (applicable for the small companies regime) and the new Schedule 3B (applicable for the micro companies regime).

Advise clients currently availing of non-filing structures of the changes to the definition of a designated ULC and the impending requirement to file accounts with the CRO that were previously not filed under old legislation. The 2017 Act requires entities where a limited liability company is included above an unlimited company (i.e. a limited parent company with a ULC subsidiary/subsidiaries) to file financial statements for the ULC with CRO by expanding the definition of designated ULCs to include additional corporate structures such as these. This would mean entities that have structures whereby at least 51% of a ULC is held by a limited company or the Limited company holds a golden share (i.e. it is a subsidiary of a parent) with the remainder (or even 1 share) owned by an individual, then these ULC’s will require accounts to be filed. This change is only effected for periods commencing on or after 1 January 2017 so therefore it would be advisable for such entities with 31 December year ends to change the year end date to the 30 December 2016 for the 2016 year so as to ensure the 2017 financial statements do not need to be filed.

The Act require entities where a limited liability company is included above an unlimited company (i.e. an ULC parent company with limited liability subsidiaries) to file the unlimited Company financial statements with the CRO by expanding the definition of designated ULCs to include additional corporate structures such as these. This section is not effective until 1 January 2022.

Advise clients currently operating in the mining and extractive industries of the requirements under Part 26 of filing payments made to governments with the CRO.

Ensure auditors are aware of their increased reporting requirements on the corporate governance statement to ensure information is consistent, whether material misstatements have been noted and that the report complies with the requirements of the Act.

Ensure auditors are aware of the fact that although Companies Act deems FRS 105 to show a true and fair view, the auditing and ethical standards does not allow this get out.