Summary

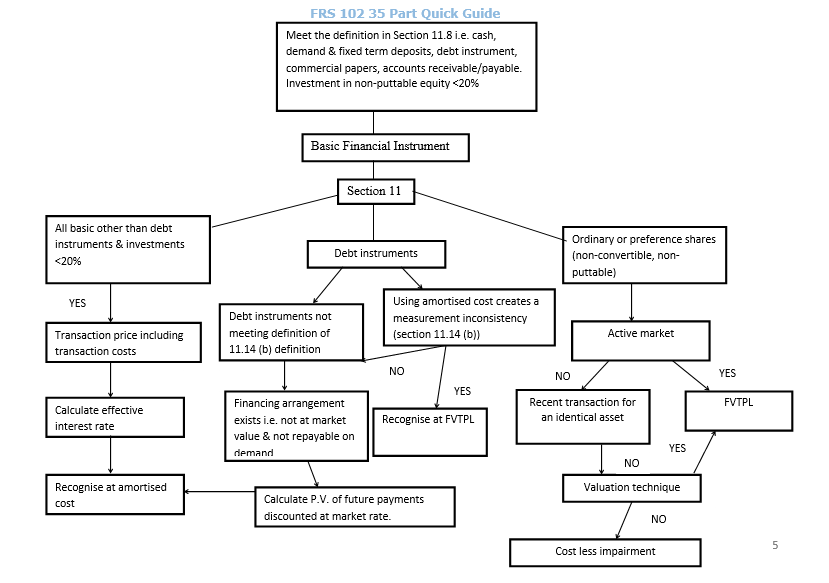

Section 11 defines basic financial instruments for all companies with the exception of public benefit entities. Basic financial instruments coming within the scope of section 11 are:

- Cash;

- Demand and fixed term deposits;

- Commercial paper and bills;

- Notes, loan receivable and payable;

- Bonds and similar debt instruments;

- Accounts payable, accounts receivable;

- Investments in non-convertible preference shares, non-puttable ordinary and preference shares; and

- Commitments to make or receive a loan to another entity that cannot be settled net in cash, loans due to or from group companies, directors loan accounts.

It goes on to provide characteristics and examples of financial instruments.

Section 11 applies to all financial instruments meeting the conditions of paragraph 11.8 except for the following:

- Investments in subsidiaries, associates and joint ventures;

- Financial instruments that meet the definition of an entity’s own equity and the equity component of compound financial instruments issued by the reporting entity that contain both a liability and an equity component;

- Leases, to which Section 20 Leases applies;

- Employers’ rights and obligations under employee benefit plans, to which Section 28 Employee Benefits applies;

- Financial instruments, contracts and obligations to which Section 26 Share-based

payment applies, and contracts within the scope of paragraph 12.5;

- Insurance contracts (including reinsurance contracts) that the entity issues and reinsurance contracts that the entity holds (see FRS 103 Insurance Contracts);

- Financial instruments issued by an entity with a discretionary participation feature (see FRS 103 Insurance Contracts);

- Reimbursement assets accounted for in accordance with Section 21 Provisions

and Contingencies; and

- Financial guarantee contracts (see Section 21).

A financial instrument is defined in Section 11.3 as a contract that gives rise to a financial asset of one entity and a financial liability of another entity.

What is new?

For previous FRS 26 adopters there are very few new concepts or differences. For non FRS 26 adopters under old GAAP, there was no equivalent standard.

Under FRS 102 entities have the option to apply either the provisions of Section 11 or Section 12 in full or utilise IAS 39 depending on the financial instrument held.

Section 11.8 defines the financial instruments which are within the scope of section 11 as basic instruments. They have been summarised in the summary above.

Section 11.9(a) states the primary conditions for a debt instrument that needs to be satisfied for the debt to be regarded as basic and so may be measured at amortised cost are:

- The contractual return to the holder (the lender), assessed in the currency in which the debt instrument is denominated, is:

- a fixed amount;

- a positive fixed rate or a positive variable rate; and

- or a combination of a positive or a negative fixed rate and a positive variable rate (e.g. LIBOR plus 200 basis points or LIBOR less 50 basis points, but not 500 basis points less LIBOR).

Initial measurement

Under old GAAP financial assets were measured at the invoiced or issued amounts less provision for impairment. Financial liabilities and debt instruments were measured at the amount of the fund received/paid regardless of when it was payable and regardless of whether they were at non-market rates. They were not required to be present valued under any other old GAAP accounting standard.

In contrast Section 11.13 deals with initial recognition, and states (with the exception of non-convertible preference shares, non-puttable ordinary shares or preference shares) the financial asset or liability is measured at the transaction price including transaction costs unless the arrangement in effect constitutes a financing arrangement. Therefore, for a loan received or a trade debtor balance a entity would record it at the value of the loan received or the value of the sales invoice issued (net of costs for loans). This would be similar for a payable position or a loan payable.

If a financing arrangement takes place which is at anything other than non-market rates then section 11.13 requires the entity to measure the financial asset/liability at the present value of the future receipts/payments discounted at a market rate of interest for a similar debt i.e. the rate of interest that would be charged on such a receivable/payable if the entity were to go to an outside party e.g. a bank etc. to get the credit. Even where a rate of interest has been charged, it still needs to be at market rates so it would have to be present valued accordingly.

A debt instrument which is repayable on demand will be carried at the consideration received or the amount of the loan provided on initial recognition as the amortised cost equates to the same amount.

Subsequent measurement

The debt instruments should be measured at amortised cost using the effective interest rate method at each reporting date. In effect if there are transaction costs then these transaction costs are charged/credited to the profit and loss over the life of the debt instrument or earlier if the period to which they relate is shorter. This contrasts with old GAAP where transaction costs on debt instruments were expensed to the profit and loss when incurred.

Section 11.15 defines amortised cost at each reporting date as the net of the following amounts:

- The amount at which the financial asset is measured at initial recognition;

- Minus any repayments of the principal;

- Plus or minus the cumulative amortisation using the effective interest method of any difference between the amount at initial recognition and the maturity amount; and

- minus, in the case of a financial asset, any reduction (directly or through the use of an allowance account) for impairment or collectability.

Section 11.14 (d) states that investments in non-convertible preference shares, non-puttable ordinary and preference shares are required to be measured at:

- Fair value (usually the bid price) if the shares are publically traded or their fair value can otherwise be measured reliably with changes in fair value recognised in the profit and loss; and

- Cost less impairment if fair value cannot be reliably measured.

Section 11.27 to 11.32 details the hierarchy when using the fair value model and details the requirements that are needed in order to be able to use fair value. The order of preference is:

- A quoted price for an identical asset;

- The price of a recent transaction for an identical asset; and

- A suitable valuation technique.

Under old GAAP where entities have not adopted FRS 26, investment in equities of this nature was accounted for at cost less impairment with an option to fair value if the entity adopted FRS 26. Therefore if an active market is present then it must fair value these equities under Section 11.

Impairments

Section 11.21 to 11.25 deals with impairment of financial assets. An impairment loss is recognised in the profit and loss where there is objective evidence of an impairment.

Under old GAAP there are no specific requirements relating to impairment of financial assets where FRS 26 was not adopted. For fixed asset investments (other than investments in subsidiaries, investment and joint ventures i.e. <20% investment), permanent diminution in value had to be recognised in the P&L under old GAAP. Current assets were measured at lower of cost and net realisable value. Section 11 gives more detailed guidance.

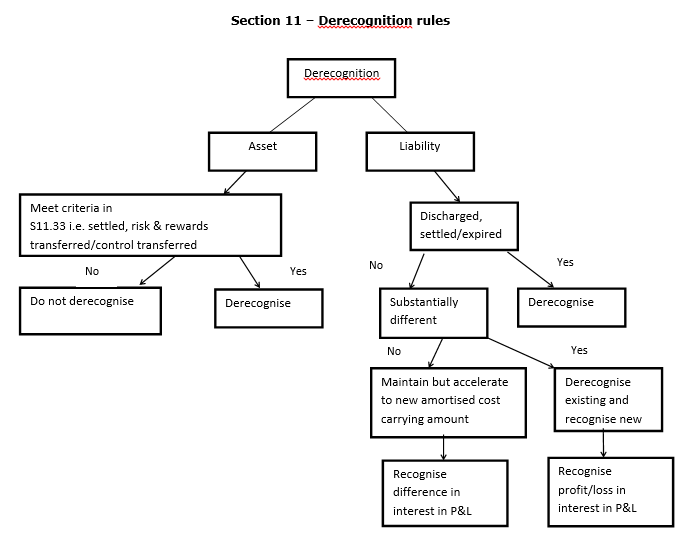

Derecognition

Derecognition of financial assets for non FRS 26 adopters was dealt with in FRS 5, where the substance of a transaction was considered. Under Section 11 there is detailed guidance in relation to when an asset is to be derecognised but essentially it should come to the same answer as under old GAAP. FRS 5 allowed linked presentation which is not allowed in FRS 102.

Derecognition of financial liabilities were not specifically dealt with in old GAAP instead FRS 5 approached liability derecognition as an issue of derecognition of a related asset. Section 11 provides detailed guidance on when to derecognise a liability and in section 11.36 it states that it should only be derecognised when the obligations specified in the contract are discharged, settled or expired.

What is different?

For FRS 26 adopters under old GAAP, the following differences arise:

- Under FRS 102 there is a two tiered model compared to a third option under FRS 26 (fair value through other comprehensive income);

- Embedded derivatives do not exist under FRS 102;

- For basic debt instruments the criteria to recognise them at amortised cost under FRS 102 are less stringent than FRS 26; and

- The disclosure requirements under FRS 102 are less onerous.

Under old GAAP there was very little disclosure required for financial assets and liabilities unless scoped into FRS 13. Under Section 11 the disclosures are a little more onerous.

Other standards which impact Section 11 where differences arise:

Section 29 – Income tax – Likely to be deferred tax on any transition adjustments which arise as a result of fair valuing at the date of transition. Also likely that tax will be payable /refundable on adjustments that fell out for tax purposes on transition.

What are the key points?

- The definition of basic financial instruments as detailed above;

- Two tiered approach model whereby financial assets and liabilities are measured at either amortised cost or FVTPL;

- Non market rate/interest free intercompany/directors loans which are not repayable on demand will have to be recognised on an amortised cost basis. This will result in a transition adjustment which will also result in a charge to the profit and loss for companies where it is a loan due and a credit where it is owed from the other parties;

- Need to fair value equity investments where they can be measured reliably based on the hierarchy detailed in Section 11.27 and Section 11.14 (d) (i) if not then they are carried at cost less impairment;

- Rules in relation to substantial modifications of the terms of an existing financial liability i.e. where there is a substantial change then the existing liability is derecognised/extinguished and a new financial liability is recognised. Where a modification occurs, the difference between the carrying amount and the new required carrying amount is accelerated; and

- Financial assets are derecognised only when the rights to the cash flows from the asset have expired or are settled; or the entity has transferred all the risks and rewards of ownership, or where ownership is transferred but control is relinquished (Section 11.33).

See below available options and a summary of the standard.

What do accountants need to do?

Get to grips with this new standard as it is likely this will be first time for a lot of accountants to have to deal with amortised cost and financial instrument accounting.

Review your client portfolio and assess the existence of debt instruments and advise clients of the impact this policy will have on the profit line (e.g. posting of interest to show the correct amortised cost at reporting date to reflect transaction costs and the deemed interest on non-market rate loans).

Advise clients where they will need to fair value equity investments of the tax implications as it may result in increased taxes as well as advising clients of the volatility the fair valuing may create in the profit and loss.

Advise clients of where dividends are being paid for periods ended after 1 January 2015, then the companies need to ensure they have sufficient distributable reserves under FRS 102 to allow for such a dividend.

Advise clients on the need for tax adjustments on transition to be included in the 2015 tax computation and beyond where items have fallen out for tax purposes as a result of the opening balance sheet being restated to show fair value of financial instruments which is non-permanent in nature.

Advise clients of the best choice i.e. chose IAS 39 or Section 11 and Section 12. Section 11 and Section 12 is a less complex standard. However, where FRS 26 was previously adopted, consideration is needed as to whether Section 11 or Section 12 should be adopted.

What do companies need to do?

Understand the differences between old GAAP and section 11 of FRS 102.

Review loan agreements entered into and quantify the effect on distributable profits as a result of the transition adjustments required to adopt this standard as it is likely that there are loans issued at non market rates (hence credit/debit posted to profit and loss) and there may be equity investments which will require to be fair valued.

Assess whether any investments in equity meet the requirement for fair valuing. If so, consider the tax impact as a result of these adjustments as it may result in increased corporation tax and therefore a deferred tax effect will need to be considered.

Where a dividend is due to be paid for periods ended after 1 January 2015, then the companies need to ensure they have sufficient distributable reserves under FRS 102 to allow for such a dividend.

Consider whether covenants on loans will be affected as a result of the new requirements and the volatility this will create in the profit and loss account if equity investments have to be accounted for under fair value rules.

Review loan agreements entered into to assess if they meet the definition of a basic financial instrument.